In an era where financial markets are in perpetual motion, private equity stands tall as a titan of investment.

The global private equity market is on an upward trajectory, with a projected CAGR exceeding 10%1. Total private market assets under management (AUM) reached $11.72 trillion as of June 30, 2022.

Private equity has become a sought-after asset class since the late 19th century. It creates jobs and fosters innovation by investing capital and expertise in companies. Understanding its components and strategies is crucial for financial success.

Let's explore the realm of private equity and principal investors and how they can benefit you.

Private equity is like a treasure chest for investors. It's an investment class that deals with money not found on the stock market. Imagine a mix of ingredients like growth capital, venture capital, leveraged buyouts, and mezzanine investments - that’s what private equity is made of.

Private equity is about long-term growth, not quick profits like buying and selling stocks. Principal investors are the big players who guide investments toward success.

Principal investors are entities that make strategic investments by deploying their capital into businesses or assets. Unlike someone who simply buys shares, principal investors are hands-on.

Principal investors are also very selective. They evaluate opportunities meticulously, considering market trends, company performance, and growth potential.

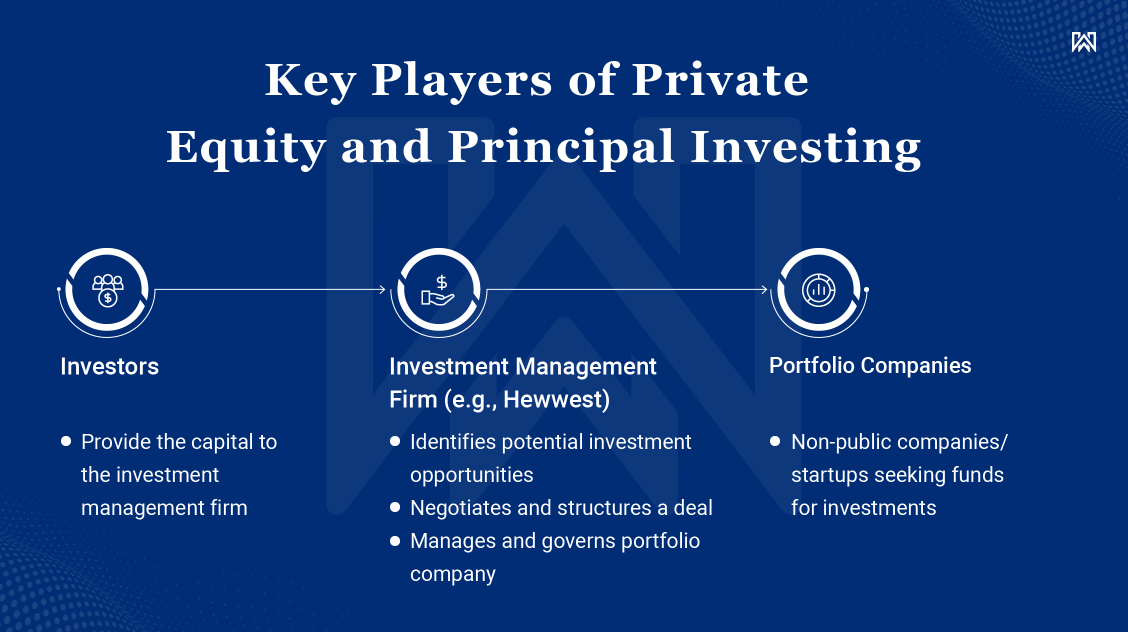

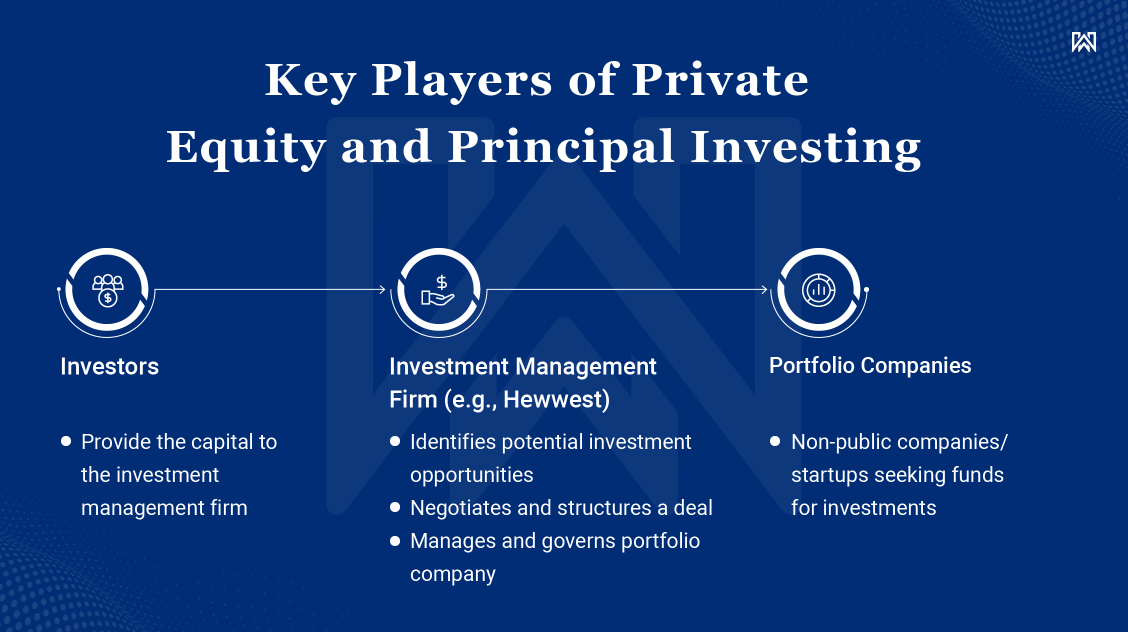

Key Players of Private Equity and Principal Investing

In the theatre of private equity, various key players take the stage. Let's look at the roles of portfolio companies, investors, and investment management firms.

Portfolio Companies

A portfolio company is a privately held company that has received an investment from a private equity firm. Typically, this investment is made to help the company grow and increase its value.

For example, a private equity firm might invest in a technology startup to provide the funding, expertise, and guidance necessary to expand its operations, develop new products or services, or enter new markets.

Investors

They are the entities or individuals who provide the capital necessary for private equity funds. These investors are discerning and employ rigorous criteria to evaluate private equity opportunities. Routine investors in private equity include sovereign wealth funds, university endowments, and high-net-worth individuals.

Also, read The Golden Gates of Stock Trading: Hidden Wealth Accelerator for the HNWIs

Investment Management Firms

They are crucial in the private equity ecosystem. They manage investments on behalf of investors, ensuring that the investments align with the client's financial goals and risk profiles.

For example, at Hewwest, we connect our investors with the right portfolio companies that fuel profitable returns to the investors’ portfolio, be it an individual, a corporate, a venture capital, or a family office.

Benefits of Private Equity Investment

Private equity investments offer several benefits, including the potential for high returns and portfolio diversification. By investing in private companies, investors will have access to the opportunities for significant capital appreciation and participation in the growth of promising businesses.

- High Return Potential: Private equity investments are known for their ability to rake in high returns. This is primarily due to the hands-on approach of private equity firms in steering operational improvements and providing strategic guidance. For instance, the acquisition of Seagate Technology by Silver Lake Partners in 2000 led to a massive return of over 500%.

- Cashflow Generation: With private equity, the cash register keeps ringing. Investments in mature companies can generate steady cash flow through operational efficiencies and dividends. This cash can be the golden goose for investors, providing a regular income stream or being reinvested for compounded growth.

- Portfolio Value Creation: Private equity firms are like the master sculptors of the business world. They meticulously chisel away at portfolio companies to enhance operations and boost profitability. Take the case of Dollar General, which flourished under KKR.

- Exclusive Investment Opportunities: Private equity investment offers access to high-caliber investment opportunities that are off-limits to the average investor. Private equity is where the action is, from investing in hot startups to niche sectors. Moreover, the correlation of private equity compared with other investment classes is low, making it a preferable choice for only ultra-high net worth individuals (UHNIs) and high net worth individuals.

- Not Easily Available in the Public Market: Private equity often involves investing in private companies that operate away from public market regulations' prying eyes. This potentially yields higher returns due to less competition and more flexible operational constraints.

- Portfolio Exit Benefits: Exiting a private equity investment is an art. Whether through an IPO, a strategic sale, or a recapitalization, private equity firms employ a range of exit strategies that can culminate in a windfall.

Private equity firms announced exits valued at a staggering $54.57 billion in the first quarter of 2023, showcasing how rigorously they circulate their money to make the most of investments.

Also, read Portfolio Transformation: Advanced Wealth Management Strategies for the HNWIs

- Ownership Influence: In private equity, investors don’t just own a piece of the pie; they have a say in how it’s baked. They influence portfolio companies significantly, guiding everything from business strategy to executive appointments.

- Portfolio Diversification: Investing in private equity can be a savvy move to diversify an investment portfolio, mitigating risks and smoothing out returns over time.

- Long-term Dividend Benefits: Private equity is a marathon, not a sprint. As portfolio companies grow and churn out profits, investors can reap the benefits through long-term dividends.

- Wider Industry Exposure: Private equity is like a passport to the business world. It offers investors exposure to many industries, from healthcare to technology, which can be instrumental in diversifying portfolios.

- Greater Control Over Investments: Investors are in the driver's seat with private equity. They exercise reasonable control over their investments, steering strategic decisions that mold the future of portfolio companies.

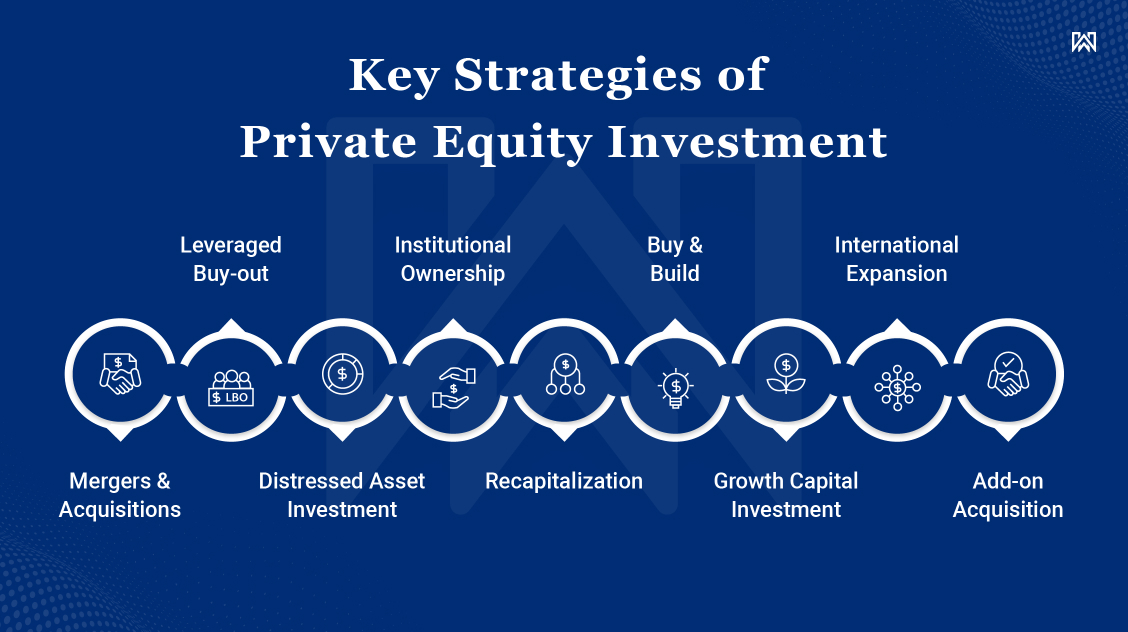

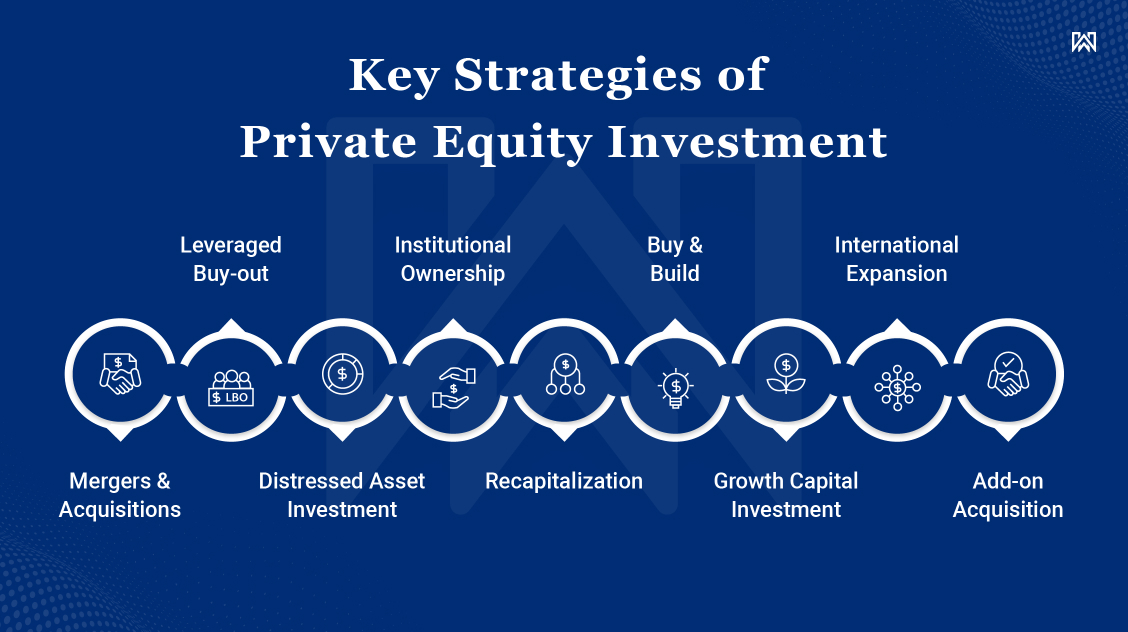

Key Strategies to Drive Growth and Value in Private Equity

Strategies define the return on investment because a suitable strategy can catapult an investment to success.

Let's dissect the key approaches that drive growth and value creation in private equity, from mergers and acquisitions to international expansion.

Mergers & Acquisitions

In March 2023, more than $628 billion in private equity deals were announced, compared to just $12 billion in January 2023. Mergers and acquisitions were most common among these deals.

By combining forces, companies can create synergies that drive growth and efficiency. A classic example is the acquisition of Heinz by Berkshire Hathaway and 3G Capital in 2013, which significantly saved costs and operational improvements.

Leveraged Buy-Out

LBO is a strategy for buying more with less, combining debt and equity to acquire companies. This strategy allows investors to amplify their returns by using the target company's assets and cash flows as collateral, potentially generating higher profits when the company is eventually sold or taken public.

Distressed Asset Investment

Buying low and selling high is the essence of investing in distressed assets. These assets have hit a rough patch and are available at bargain prices. Private equity firms can turn these companies around and sell them for a profit.

Recapitalization

It is like giving a company a financial makeover. It involves altering a company's capital structure, which is used to seize financial opportunities or fortify the balance sheet.

Institutional Ownership

Having institutional investors is like having a financial guardian. They provide a stable source of capital and often have a long-term investment horizon which is particularly beneficial for private equity investments and often requires time to mature.

Buy and Build

The buy-and-build strategy is akin to acquiring and building a foundation. Private equity firms acquire a company and then expand it through additional acquisitions. Audax Group is known for employing this strategy successfully across various investments.

Growth Capital Investment

Growth capital is another crucial strategy that helps companies expand operations, enter new markets, and ramp up marketing efforts simultaneously. Warburg Pincus's investment in Bharti Televentures in the early 2000s exemplifies a successful growth capital investment.

International Expansion

Expanding beyond borders can be a game-changer. Companies can tap into new customer bases and diversify revenue streams by entering international markets. Carlyle Group’s investment in Moncler exemplifies how international expansion can drive growth.

Add-on Acquisition

Add-on acquisitions involve adding new companies to an existing portfolio. This can create synergies, drive growth, and diversify revenue streams. For example, TransDigm Group has successfully used add-on acquisitions to expand its aerospace business.

Safeguarding Investors’ Funds: Collaterals of Private Equity

Collaterals serve as a financial safety net in this domain. Essentially, collaterals are assets pledged by a borrower to secure an investment. If the borrower defaults, the lender has the legal right to seize the collateral.

In private equity, collaterals can range from assets to shares to guarantees. They provide investors additional security, ensuring there is something to fall back on in case things go south.

|

Company Assets

|

Equity Shares

|

Personal Guarantees

|

|

Real estate, machinery, and inventory can be pledged as collateral.

|

Represent ownership in a company and can be used as collateral.

|

An individual’s assets, such as property or bank accounts, are pledged as collateral.

|

|

In default, the company may lose these assets, impacting its operations.

|

The default may result in a transfer of ownership, diluting the company's control.

|

The guarantor risks losing personal assets in case of default.

|

|

The investor can seize and liquidate these assets to recover the investment.

|

The investor may gain ownership or a significant stake in the company.

|

The investor can seize the guarantor's assets for recovery.

|

Escalate Your Investment With Hewwest: Superior Private Equity Services

Hewwest is a formidable private equity player known for its astute investment strategies and client-centric approach.

Here is how Hewwest's services can catalyze your investment growth.

- Extensive Network: Hewwest’s far-reaching network is a treasure trove for investors. With access to many exclusive investment opportunities, Hewwest is the gateway to a diversified investment portfolio.

- Specialized Funds: Catering to a spectrum of investor preferences, Hewwest offers specialized funds. Whether you are risk-averse or an adventurous investor, Hewwest has a fund that aligns with your goals.

- Capital Raising Opportunity: Hewwest’s acumen in capital raising is unmatched. Investors reap the benefits as Hewwest adeptly secures funds for various ventures.

- Mergers and Acquisitions Guidance: The labyrinthine world of mergers and acquisitions is simplified with Hewwest’s expert guidance, ensuring investors steer through transactions seamlessly.

- Trust and Confidence Building: Hewwest is synonymous with trust. Through transparent communication and battle-tested strategies, it instills confidence in investors.

- Demonstrated Expertise: Hewwest’s track record in the private equity sector speaks volumes. This expertise is the bedrock of success for investors who choose Hewwest.

- Seasoned Financial Experts: The team at Hewwest is its crowning glory. Comprising seasoned financial maestros, their insights and experience are invaluable for investors.

- Personalized Portfolio Performance Analysis: Hewwest goes the extra mile with bespoke portfolio performance analysis, empowering investors to make decisions with clarity and confidence.

Still, wondering about your next step?

Don't miss out! Tap into a world of smart investments with Hewwest. Get the best advice, access to hot deals, and a team that has got your back.

Sources

Source 1

Source 2

Source 3

Source 4

Source 5

Source 6

Source 7

Source 8